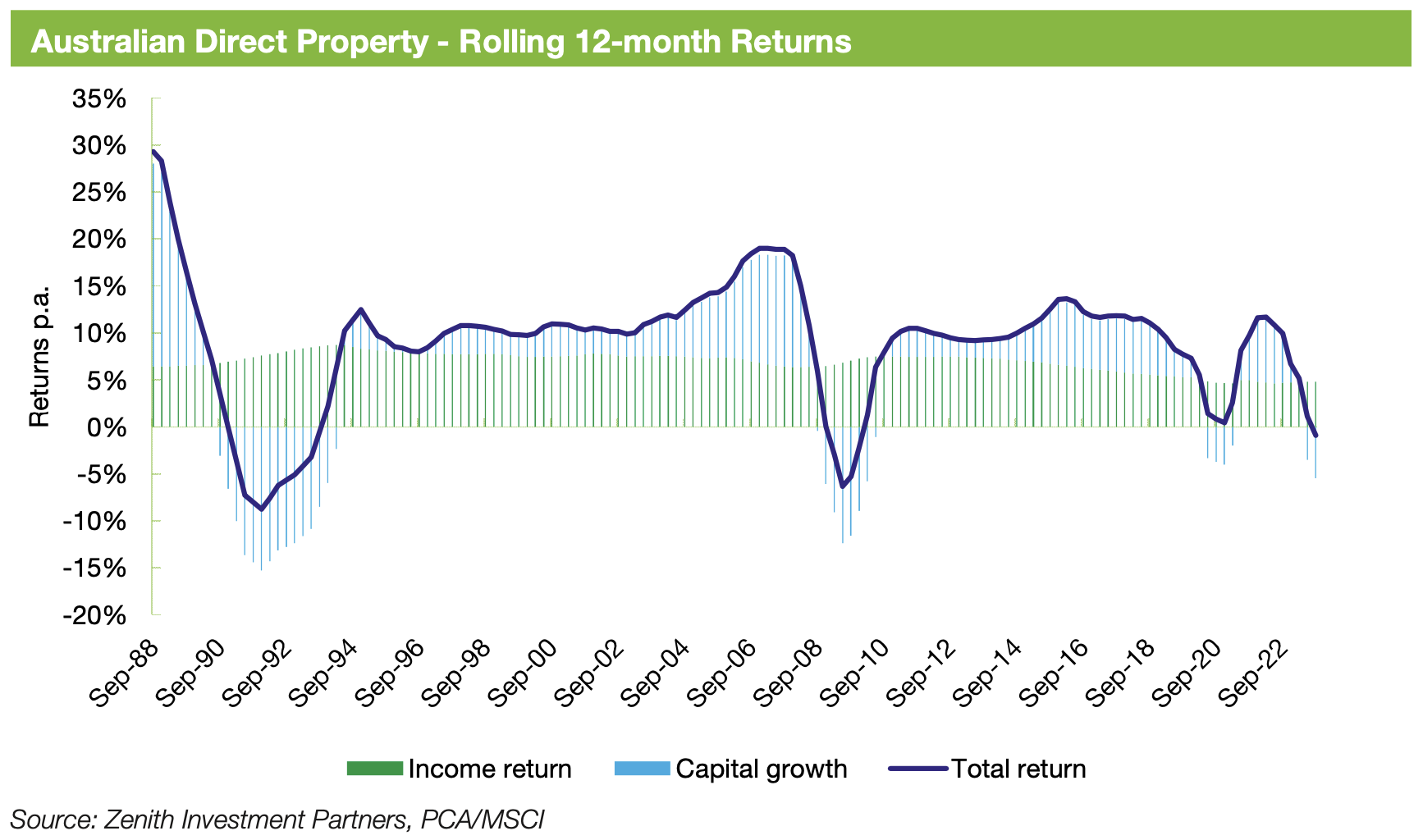

Third dive in real estate total returns in 30 years

The degree to which direct property investment has proved problematic has been underlined by the fact that, for only the third time in the past 30 years, total returns have turned negative on a rolling 12-month basis.

A Zenith Investment Partners sector report on Real Assets has pointed to the issue but, at the same time, has noted the value of real assets within portfolios in terms of providing diversification relative to bonds and equities and the need for investor patience.

However, the bottom line is that the over the 12 months to 30 September, last year, Zenith’s rated Real Assets peer group delivered returns on average of negative 3.91% and where Australian real estate is concerned Zenith said the median manager returned negative 5.58%.

It noted that the performance of Australian managers in the sector ranged from negative 10.99% to 5.63%.

“Across Direct Property, performance continued to weaken across all sub-sectors as valuations were impacted by higher debt costs,” it said. “The Industrial sector continued to outperform Office and Retail which face specific headwinds from soft tenant demand, higher vacancies and sluggish rent growth.”

“It is worth noting that this is only the third time in 30 years that the total returns to Australian direct property have turned negative on a rolling 12 month basis and is the direct result of valuation declines as a consequence of the sharp increases in interest rates over 2022 and 2023,” the Zenith analysis said.

The analysis also noted that global direct property returns had also been weak over the past year, with the sector facing similar headwinds of higher interest rates and softening valuations.

“Performance across the rated peer group ranged from -4.55% to -17.53%, with the median manager returning -8.87% for the 12 months to 30 September 2023. Similar to Australia, performance in the Industrial and Logistics sector remains elevated in comparison to other subsectors. Peer-relative performance in this sub-sector can also be influenced by movements in currency, with varying levels of hedging applied.”

While outlining the negative return environment, the Zenith analysis said investment in real assets represented a longer-term strategy that required consideration within a wider portfolio context.

“The current heightened lack of liquidity in many sectors is the result of elevated withdrawal requests across much of the asset class at a time when there are valuation concerns, and therefore little in the way of inflows. We believe this illiquidity will ease as a greater number of physical transactions are realised and valuations find their level,” it said.

“Despite occasional capital value declines, the sector nonetheless produces stable income streams and has, in a historical context, rarely produced negative total returns. As a result, patient investors are unlikely to observe long-term value decline.”

So whilst the overall Retail, Commercial, Industrial, etc property markets ALL declined.

Industry Super’s same property classes but Unlisted were positive returns.

Tell it like it really is son.

BULLSHIT ISA VALUATION !!!!!