Global insto investors regain some appetite for risk

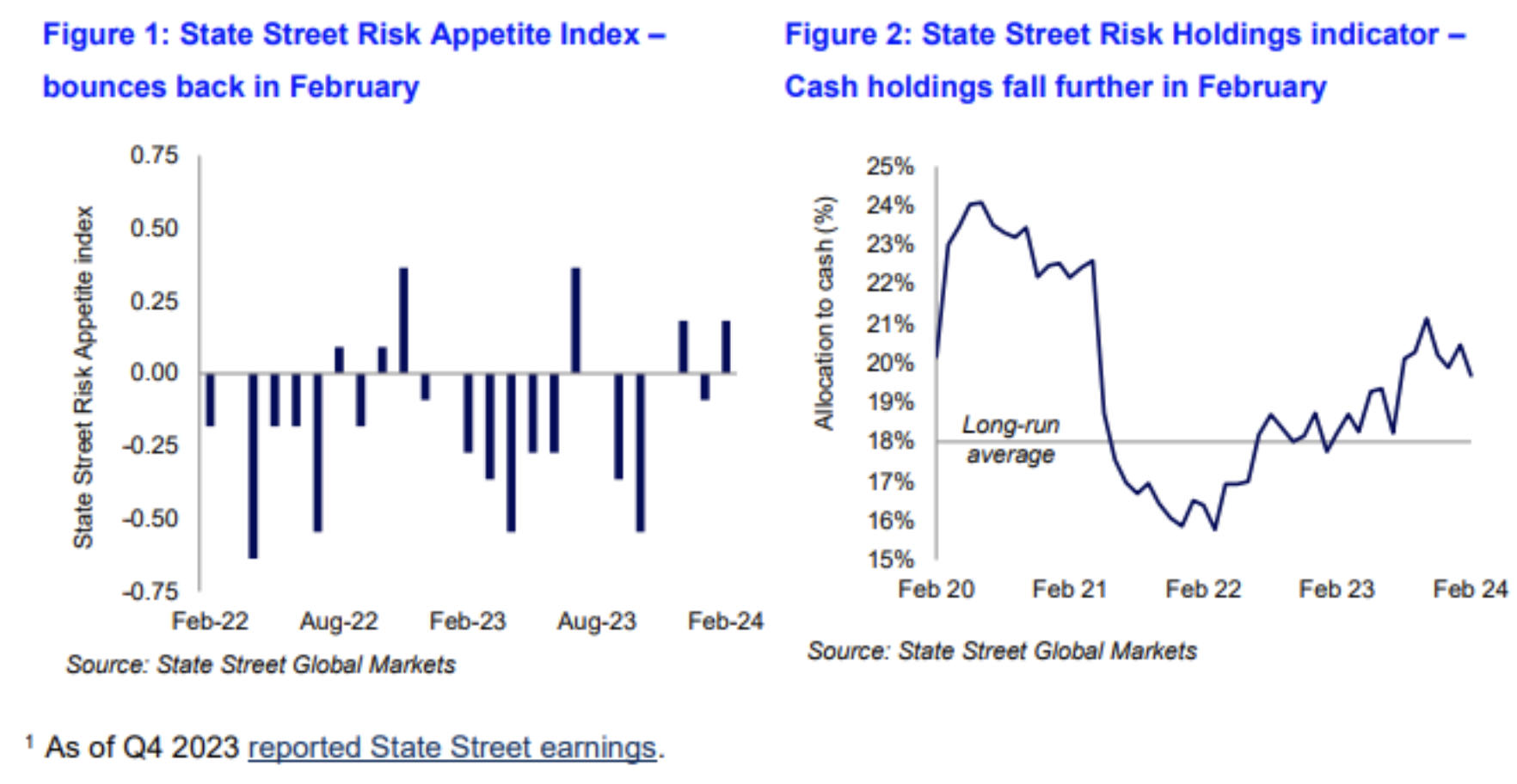

Institutional investors have regained some of their risk appetite with the latest State Street Risk Appetite Index have exhibited a modest rebound in February.

State Street Global Markets said the index lifted from -0.09 to 0.18 in February.

Commenting on the improvement, State Street Global Markets Head of Macro Strategy, Michael Metcalfe said equity market returns were simply too good to miss in February.

“Even though hopes of interest rate reductions have been pushed out to June and possibly beyond, the combination of low volatility and solid US growth has been sufficient on balance to encourage investors into riskier assets, especially in equity and FX markets, where in both cases we noted an improvement in relative demand for selected emerging markets, including China,” he said.

The State Street Holdings Indicators showed that long-term investor allocations to equities rose by 1.2 per centage points to 52.8%, this was funded by a 0.8 percentage point fall in cash holdings to 19.7% and a further 0.4 percentage point fall in fixed income allocations to 27.5%.

“The improvement in risk appetite was especially notable in another sharp fall in cash holdings, which fell by almost a per cent over the month. Cash holdings are now only 1% above their long-run average. This marks the smallest overweight in cash in eight months and hints that investors ‘dry powder’ is beginning to run out,” Metcalfe said.

“Even with much higher short-term rates on offer, this demonstrates that institutional investors are happy to move out of cash if the market conditions elsewhere are conducive. And with interest rate uncertainty lingering for the moment this means equities, where holdings rose sharply once again. They are now at a seven month high and are only a per centage point below their highest reading in the past decade. This is a telling sign of investors’ growing conviction, or perhaps complacency, that despite uncertainties in the economic, political and geopolitical outlook equity markets will remain resilient.” Metcalfe said.

Well, there's a very sound default reaction by any clear thinking adviser to this story - SO WHAT?! If there…

Was exactly what I was thinking "researcher". ASIC completed a look back on advisers, time for a look back on…

They're like a zombie that you can't kill

This answer from ASIC does not stack up. The current Chair and Deputy Chair for enforcement commenced on 1 June…

How about ASIC does a look back, just like they forced advisers to do. Advisers had to justify everything they…