Adviser exits and Govt policy weigh on life/risk market

The exodus of life/risk advisers combined with the Australian Prudential Regulation Authority’s (APRA’s) intervention in the individual disability income (IDII) insurance market continue to impact the sector with only fleeting signs of recovery.

New data analysis released by specialist research house, Dexx&r has pointed a stark picture of how Government policy changes have impacted the life/risk market in Australia, including the normally durable group insurance sector.

The latest analysis from Dexx&r has revealed that total risk in-force premiums grew by just 0.4% during the year ending December, 2023 to $16.5 billion.

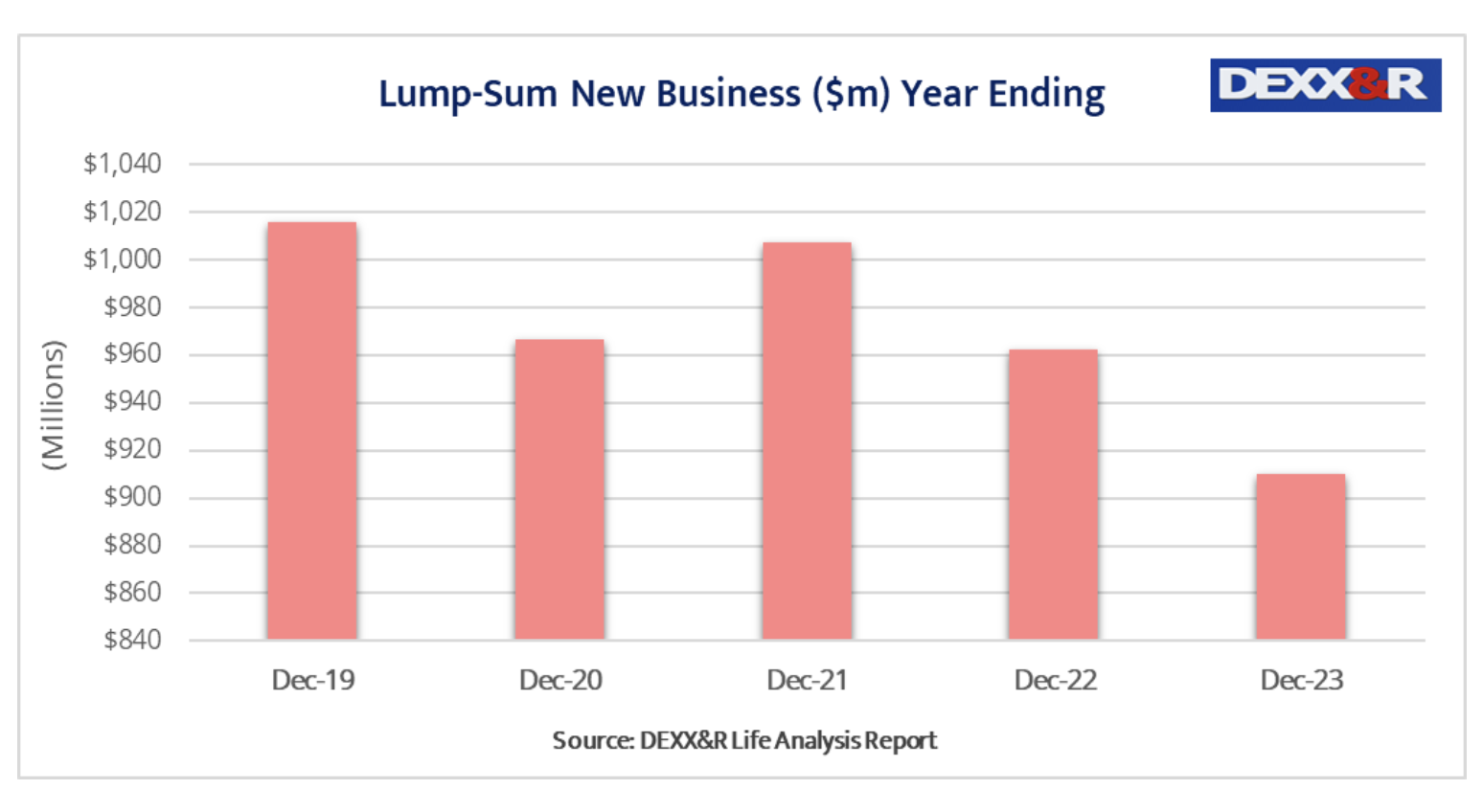

However, the Dexx&r analysis also pointed to the individual risk lump sum new business being down 5.4%.

Equally reflective of the state of the market was the fact that individual lump sum discontinues continued to increase, in December to 10.1%.

In contrast, disability income new business increased by 7.3% over the year to December to $451 million, up from $420 million in the prior corresponding period.

The analysis showed that the attrition rate for Disability Income business continued to climb from the 9% recorded in December, 2020, immediately prior to the release of a new range of disability income products following the APRA intervention and the release of conforming products in 2021.

Dexx&r said that in-force group business was down one per cent for the year to December, 2023, noting that the group risk market is dominated by premium received for the provision of default cover for super funds.

“While the Protecting Your Super measures have meant that fewer members have default cover, total premium received has continued increase as the result of re-pricing of existing benefits,” it said.

Total In-force Group Risk Premium decreased by 1.0 per cent from $7.1 billion at December 2022 to $7.0 billion over the 12 months to December 2023.

TAL continued to hold the most market share with 32% followed by AIA Australia, Zurich and MLC Life.

Don’t worry. Once the new “Qualified Advisers” become reality they will fix the underinsurance problem by writing insurance for everyone that will be owned by the industry super fund they work for. Do industry super funds receive commissions on the life insurance policies they own. Yes the do, but that’s okay because they are morally superior. Just ask them, they will tell you. Only financial advisers who should be banned from receiving life insurance commissions. Just another abomination that the main stream media deliberately avoids.

Underlying trends are far worse than statistics might suggest. Discontinuances are being held artificially low due to clients slashing sums insured and benefit options, rather than cancelling outright. But it is just a temporary measure for most clients, who are angry and fed up.

Discontinuance rates will soon skyrocket, as a delayed response to skyrocketing premiums. There will be insufficient new business to replace what was lost, as insurance advice has been killed off by bad regulation, and consumers do not adequately insure themselves without advice. The pool of insured lives will become smaller, older, and sicker. The whole industry is unsustainable.

Who is surprised