No LIF for super funds despite ASIC finding insurance shortcomings

At the same time as financial advisers wait for the Government to determine the future of the Life Insurance Framework (LIF) an Australian Securities and Investments Commission (ASIC) report has identified continuing shortcomings with respect to insurance within superannuation.

The regulator has released Report 760 which represents a follow-up to its earlier review of insurance inside superannuation and while it identified some improvements on the part of the superannuation funds and their insurers it made clear there is further to go, particularly with respect to claims handling.

Where claims handling is concerned, the report said: “data on claims handling across the superannuation industry suggests that trustees and insurers need to do more to remove frictions in the claims handling process, including by helping members to understand what their insurance covers them for and what they need to do to make a successful claim.

“For example, the share of TPD claims that are withdrawn increased to 6.7% in June 2022, and the number of disputes relating to insurance in superannuation claims that are recorded by insurers through internal dispute resolution remains relatively high,” the report said.

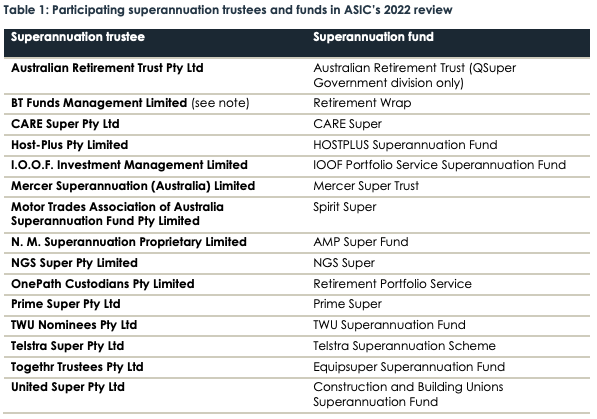

The ASIC report looked at a cross-section of retail, industry and corporate superannuation funds:

On a more positive note, ASIC said it had seen improvement to how some trustees were designing default insurance in superannuation to better meet member needs, including using data to monitor member outcomes.

“These changes are a positive step towards reducing the risks of members receiving insurance that does not meet their needs or paying for cover they cannot claim on,” the report said.

“However, trustees need to continue improving how they monitor and respond to these risks, including by regularly examining outcomes for cohorts of their membership and identifying how they can improve the value for money that members receive from their insurance.”

In the sometimes vexed area of total and permanent disability TPD insurance, ASIC pointed to the findings of its 2017 report which found problems with claims assessed under the “activities of daily living” definition and noted that “some superannuation trustees and insurers had eligibility criteria for TPD cover that funnelled certain groups of members into these restrictive definitions, meaning they were paying for TPD cover but were much less likely to have a claim accepted”.

In its latest report it said it had found that most of the 15 trustees had taken action to modify or remove restrictive TPD definitions from their default insurance:

› Two of the trustees have removed their ADL definition completely. This means all new TPD claims for their members will be assessed under the standard ‘any occupation’ definition.

› Nine trustees have replaced, and one trustee is in the process of replacing, the ADL definition with an ADW definition.

› One trustee previously required a portion of the TPD benefit to be assessed under the ‘any occupation’ definition, and the remaining portion under the ADW definition. For all new claims, the entire TPD benefit will be assessed under the ‘any occupation’ definition.

› The remaining two trustees said they are still reviewing their TPD definitions in consultation with their insurers.

What a mess! There is a huge divergence in quality of TPD definitions in industry super. Risk specialists have ALWAYS known this, but others think “they are all the same” And as the ASIC report says, terms of TPD can be changed overnight by TRUSTEES. Or abandoned, purely by a members notification letter that no one reads