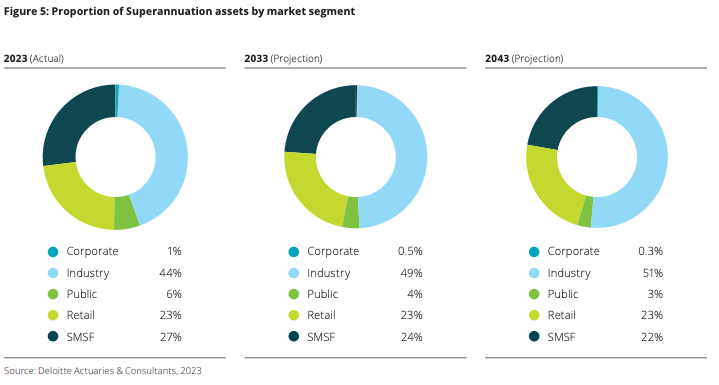

25 mostly industry funds now represent 96% of the market

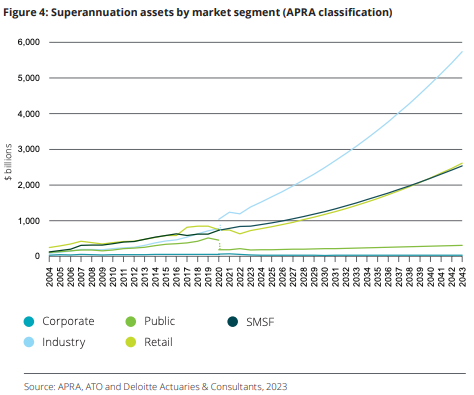

Industry funds are on course to become by far the dominant force in Australian superannuation, according to the latest research from Deloitte.

The research, which is being distributed today, will create more debate around the degree to which recent Government policy measures, including the Quality of Advice Review (QAR), will further empower industry funds through the delivery of financial advice.

Deloitte’s Dynamics of the Australian Superannuation System – the next 20 years to 2043 – finds that industry funds and self-managed superannuation funds (SMSFs) will be the dominant sectors in the pre-retirement space and that while retail funds will continue to grow it will not match the pace of the industry funds.

The research also points to stapling as generating further momentum for industry funds stating that they “will benefit from the ‘stapling’ of superannuation accounts, and individuals being more likely to be industry fund members at the point of retirement and therefore continuing to remain in that fund post-retirement”.

“Because of their older demographic, the SMSF sector already has a significant proportion of its assets supporting pensions in payment but will grow less strongly due to their high cash outflows,” it said.

It said many industry funds are also improving their investment propositions for members, incorporating options which provide access to:

- A selection of diversified multi-asset class investment options (TDPs).

- Asset class building blocks which allow a member to construct a well-diversified portfolio that reflects their risk tolerance and appetite for various asset class exposures. Dynamics of the Australian Superannuation System | Components of the market

- Low-cost (or passive) options for the major asset classes to allow members to address concerns on investment cost and implement a strategy which is consistent with their views on active management.

- Tailored Environmental, Social and/or Governance (ESG) investment profiles delivered through either a specifically tailored option, or through an investment framework with overarching ideals.

- Member Direct Options which allow members to directly invest in large ASX-listed company shares, ETFs and managed funds, giving members greater control in selecting their investments in superannuation, if desired.

“The low fees and strong investment performance of industry funds, combined with strong inflows, will result in a growth rate of approximately 10% per annum for industry fund post-retirement assets, compared to 6.8% for retail funds and 6.4% for SMSFs,” the Deloitte research said.

Deloitte partner Andrew Boal said it was important to note that when looking at cashflows the largest eight funds were dominant.

Further, he said that the top 25 funds regulated by the Australian Prudential Regulation Authority (APRA) now represent 96% of funds under management.

ISA now effectively run the Canberra bueracracy. And that power will only grow.

Left Wing Loonies are winning control of the country.

I’ve saved this article as a .pdf – I’m very confident that the outcome here will be massively wrong.