Keep $3m super tax regs gender neutral

The Federal Treasury has been urged to keep gender and Family Law considerations out of the regulations surrounding the Government’s proposed $3 million superannuation tax cap.

The Association of Superannuation Funds of Australia (ASFA) has taken issue with Treasury’s proposed regulatory approach which would see Family Law valuation factors be used with respect to the valuation of defined benefit superannuation accounts.

However, it said that this, generally, would lead to females with a life pension or a pension linked to life expectancy being assessed with a higher tax amount in the case of life pensions given their longer life expectancy.

As well, it said that superannuation funds might not have definitive information on the gender of a fund member.

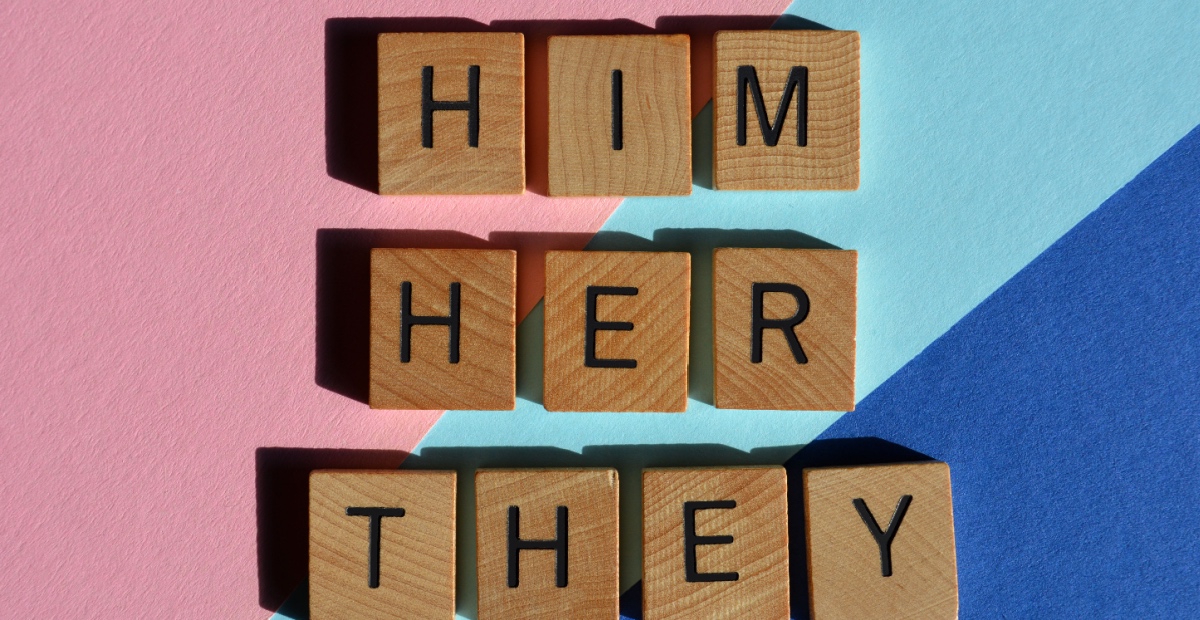

“While gender information is an integral part of Family Law proceedings it does not have the same relevance in most instances for defined benefit pensions, which are paid at the same rate for males and females,” ASFA’s submission said.

“As well, some individuals do not accept a binary definition of gender and/or do not declare their gender to a fund. Funds should not be required to ask all defined benefit members about their gender at birth, especially as only a very small proportion of those with a defined benefit interest will be subject to the Division 296.”

“ASFA considers that females and males at the same age and with the same benefit salary or life pension should pay the same amount of tax. Accordingly, the valuation factors in the Family Law regulations for males should be used for both females and males,” the ASFA submission said.

It said this could be achieved by applying the valuation factors developed for males to also be used for females, thereby reducing the complexity of administration and cost of implementation. An alternative approach would be to use an average of the male and female factors.

I have clients who have been told to produce evidence they are with cbus or else they can't work on…

Unionist were appointed to the Reserve Bank Board as some sort of pay off. You missed where the Wayne Swan…

It concerns me that only months ago the Government was considering giving Union based Industry Funds the power to advise…

Can you imagine the corruption that would occur if the Government goes ahead with its plan to allow Industry Super…

Let's pretend that I am a super fund trustee and I want to build an office building on behalf of…