Older and advised: The big super account holders

The degree to which those aged over 60 dominate superannuation assets has been laid bare by the latest data produced by the Australian Prudential Regulation Authority (APRA).

What the data show is that not only do older Australians command the largest superannuation account balances, but most of those balances are held in choice products which are commonly the subject to the receipt of financial advice.

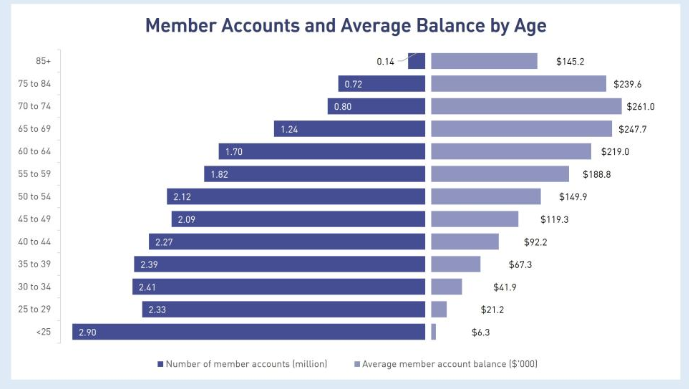

Not unexpectedly, the data confirm that while 60% of superannuation fund members are aged under 60, they account for barely 35% of superannuation assets.

The ASIC data show that average superannuation balances peak between age 70 to 74 at $261,000 and only decline modestly to $239,600 in the 75 to 84 age cohort with the major draw-down occurring thereafter with those aged over 85 holding an average balance of $145,200.

The data confirm Treasury analysis that many Australians are dying with substantial superannuation balances – something which is likely to fuel continuing discussion around the superannuation and estate planning.

The APRA data also confirm the dominance of choice superannuation products in terms of account balances.

It points to the fact that while there are 14.3 million MySuper accounts they cover just $911 billion in assets compared to 7.5 million in choice accounts accounting for $1,113 billion in assets.

The data provides a backdrop to APRA’s efforts to apply the superannuation performance test to choice products when there are 64 MySuper products and 937 choice products.

The evidence is mounting.

It is not the fault of advisers who care and do right by their clients. ASIC is culpable for failing…

Oh Yes, it Can, Look at Storm Financial and the long laundry list of failures that ASIC did nothing before…

He thinks that will not matter in my view or he wouldn't be so unresponsive. He probably is getting some…

Have a read of this and you can see Treasury notifying government that the Dixons compensation is going blow out…