SMSF Assoc urges cross-bench amendments to $3m super tax

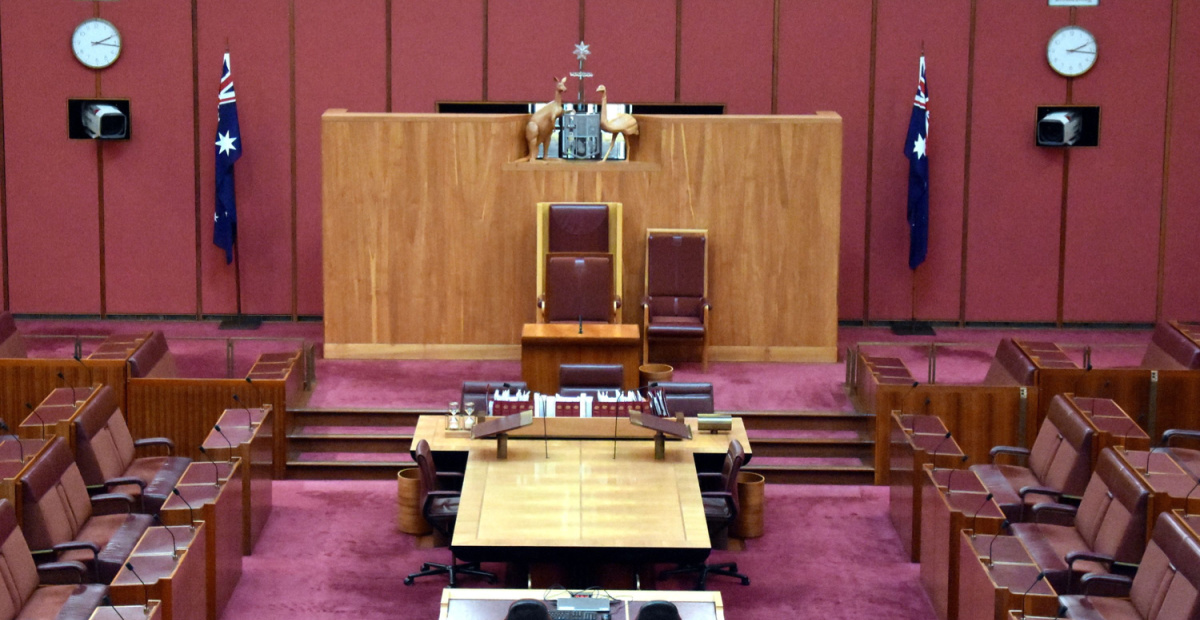

The Self-Managed Superannuation Funds Association is urging the Senate cross-bench to force amendments to the Government’s $3 million superannuation tax cap legislation, after a key Senate committee recommended no change.

The SMSF Association chief executive, Peter Burgess said his organisation was urging the Senate amendments in circumstances where it was bitterly disappointed the Senate Economics Legislation Committee had issued a final report urging passage of the bill.

The committee comprises three Labor members, an Australian Green, two Liberal members and ACT independent, David Pocock.

“…the recommendation to proceed with the Bill without amendment ignores the considerable and unequivocal weight of evidence presented during the inquiry that this new tax will have many unintended consequences,” Burgess said.

“The assertion in the Committee’s report that all superannuation trustees have a legislative obligation to keep sufficient liquidity and therefore the taxation of unrealised capital gains should not be a liquidity concern lacks commercial realism,” he said.

“It is completely unreasonable to expect trustees, when formulating a long-term investment strategy such as investing in real property, to forecast future tax changes, particularly a change that is such a radical departure from existing tax policy.

“We also note the recommendation in the Australian Green’s dissenting report that the threshold be lowered to $2 million.

“Lowering the threshold will only exacerbate the impact of taxing unrealised capital gains – it will not only widen the tax net but, for many, it would also mean a greater proportion of the unrealised capital gain is subject to this tax,” Burgess said.

“This is a fundamentally flawed tax on so many levels and we are calling on the Senate crossbench to halt the progress of this Bill and instead continue to engage with stakeholders and the industry to ensure that the resulting policy and legislation delivers the right outcomes.”

The final report carried dissenting reports from both the Federal Opposition Coalition and the Australian Greens, with the Coalition members of the Labor-dominated committee recommending that the legislation not be passed in the absence of significant amendments.

Yeah, add this to the track list of Canberra's greatest hits.

What about the genesis of the term "Qualified Adviser". Did we ever learn of the clown who devised that term…

AMP don’t have any control over where the linked adviser channel places their business. The Joint parliamentary committee seems to…

Too little too late … they will dismiss you like your nothing!!

Is it clear who instructed Dixon remain as an AFCA member? There was a question on notice in the senate…