Strong share market tide lifts retail super boats

With almost all superannuation spruiking their financial year investment returns, specialist research house, Chant West has placed their results in context pointing to moment the funds derived from strong share markets.

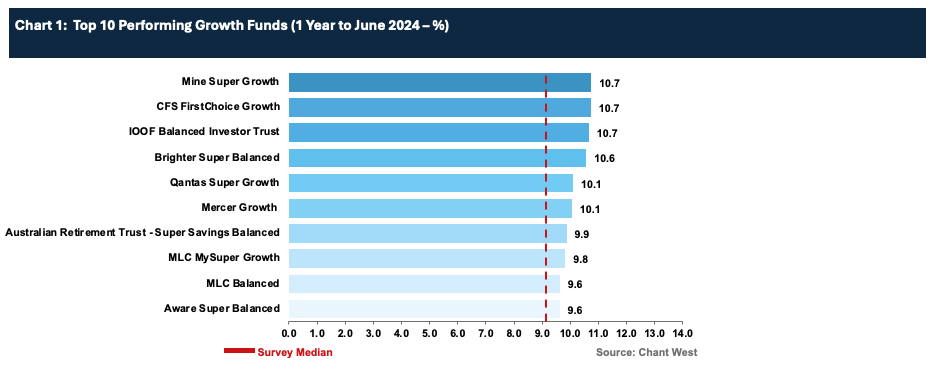

Chant West pointed to the median growth fund (61% to 80% in growth assets) returning 9.1%.

And the strong performance of share markets also brought retail funds to the head of the pack five out of 10 retail funds being counted in the top 10 although when taken over 10 years, industry funds were absolutely dominant.

However, for FY24 the Top 10 includes CFS, IOOF, Mercer and MLC.

Chant West Senior Investment Research Manager, Mano Mohankumar, made clear that strong share markets were the main driver of the better-than expected FY24 result.

“International shares was the greatest contributor, surging 21.5% over the year, led by the strong performance of the tech sector. While not reaching the same heights, Australian shares also had a healthy year returning 11.9%,” he said.

“The return experience over the past two years in the face of much uncertainty is another reminder of the importance of remaining patient and maintaining a long-term focus. If you think back two years ago, FY23 kicked off amid surging inflation and uncertainty around when interest rate hikes might come to an end. At that time, I don’t think anyone could have forecast a 19% return over the subsequent two years and the small FY22 loss of 3.3% now seems like a distant memory.

“With share markets performing so strongly in FY24, especially international shares, it’s not surprising that the better performing super funds generally had higher allocations to those asset classes. In fact, all major asset classes were in positive territory over the year with the exception of unlisted property, which was hurt mainly by downward revaluations in the office sector.

“We’re still in the process of collecting final returns for unlisted asset classes such as unlisted property, unlisted infrastructure and private equity. While the loss for unlisted property over FY24 is likely to be in the high single digits on average, we estimate that unlisted infrastructure and private equity finished the year with gains in the 5% to 7% range,” Mohankumar said.

“Listed real assets were also up, with Australian listed property returning an impressive 23.8%, while international listed property and international listed infrastructure yielded more modest gains of 4.6% and 2.6%, respectively. Traditional defensive sectors were also up with cash, Australian bonds and international bonds advancing 4.4%, 3.7% and 2.7, respectively.”

Mohankumar said that while super funds had a good FY24 with a median return of 9.1%, that level of return shouldn’t be thought of as normal.

“The typical long-term return objective for growth funds is to beat inflation by 3.5% p.a., which translates to just over 6% p.a. Since the introduction of compulsory super, the annualised return is 7.9% and the annual CPI increase is 2.7%, giving a real return of 5.2% p.a. – well above that 3.5% target. Even looking at the past 20 years, which includes three major share market downturns – the GFC in 2007-2009, COVID-19 in 2020 and the high inflation and rising interest rates in 2022 – super funds have returned 7.2% p.a., which is still comfortably ahead of the typical objective.

“Returns are important but so is risk, and most funds also set themselves a risk objective. Risk is normally expressed as the likelihood of a negative annual return, and typically a growth fund would aim to post no more than one negative return in five years on average. This objective would translate to no more than six negative years over the 32 financial years shown. As it turns out, there have only been five, so the risk objective has been met as well as the performance objective.”

All in the name of access to advice.... But in fully qualified adviser land... oh no, you cannot have that....…

How is HESTA paying for the adjustments? Who pays for the market moves? All members? This is not communicated in…

The whole concept of another class of financial advisers who don't need to meet the same red-tape requirements, or education…

Yeah, typical - one set of rules for Advisers and non Industry Super and a completely different set of rules…

No doubt that I'll be going into the Xmas break wondering why in the hell I bothered doing a masters…