Super funds’ internal investment teams may be managing $1.3 trillion

Superannuation fund internal investment teams could be managing as much as $1.3 trillion of Australian superannuation assets.

Total Australian superannuation assets currently stand at $3.5 trillion.

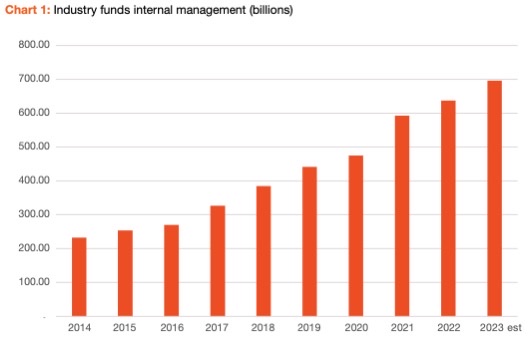

That is the assessment of industry funds-linked Frontier Investment Advisers which has pointed to the rate at which investment mandates previously awarded to external fund managers are being replaced by internalised teams.

What is more, Frontier argues that the internal teams should be held to the same performance benchmarks as external managers in circumstances where the firm has observed “a few internal investment processes that don’t compare well in their articulation or implementation versus external managers”.

Among the funds to internalise investment management have been AustralianSuper, Cbus and Australian Retirement Trust with many other, smaller funds following wuit but Frontier has suggested these internal teams bring with them increased risk.

The Frontier analysis, published last week, argues that the internalisation strategy “inevitably raises unique governance questions, while its rapid growth suggests a more robust approach is warranted”.

“There is no clear data about the size of internalisation strategies, with estimates ranging from $700 billion to $1 trillion of all industry assets and anecdotal evidence suggesting the figure could even be as high as $1.3 trillion,” it said. “

While APRA has recently overhauled risk-focused regulation and guidance aimed at fund liquidity and valuations, internalisation strategies are covered in a more general way,” the Frontier analysis said.

“While some leading funds are improving the way they monitor, assess, manage, and ameliorate these risks, more needs to be done across the industry. There are two areas that asset owner boards and management should be focused on: internal investment teams; and the internal investment models that funds rely on.”

“Without stronger oversight, review and challenge, it is likely the drive towards larger internal investment teams and the greater use of internal investment models will lead to more risk,” the Frontier analysis said.

50% Unlisted Assets, vertically owned internal Asset managers and their own valuations.

What could possible go wrong ?

Let’s add some vertically owned back packer call centre sales Advice collectively charged to all members by HIDDEN COMMISSIONS.

Industry Super Funds, the funds with the most conflicted interests ever.

Unlisted Property and Private Credit is booming for these Super funds. Private Credit like Aware Super getting their in-house advisers to invest in their own private debt, that was used to buy State Super Financial Services and pay a $20 million penalty incurred via a fee for no service court case, and then you write those debt instruments off. What can be wrong with that thinking especially when you combine it with large investments in unlisted property.