AMP mandate reinforces TAL’s dominance

Major life insurer TAL has cemented its group insurance market dominance by picking up the mandate as the default and retail insurance provider for the AMP Superannuation Fund, including AMP’s Signature Super offer.

AMP announced that TAL had been selected following an extensive tender process which covered Australia’s leading life insurers.

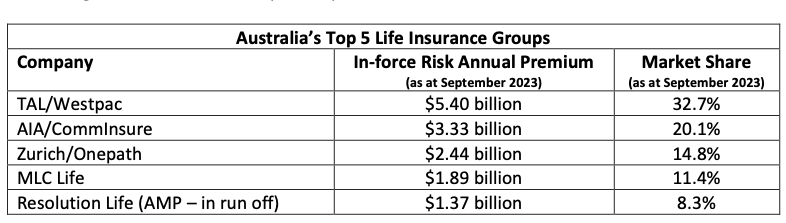

The mandate win for TAL comes just weeks after the latest market share analysis by specialist life/risk ratings house, Dexx&r listed TAL as being the dominant player in the life insurance arena, holding 32.7% market share, ahead of AIA with 201%.

In announcing the selection of TAL, AMP emphasised what it described as the company’s member-first and digitally-enabled experience.

Commenting decision, AMP general manager, Master Trust, David Clark said members would benefit by way of insurance pricing reductions along with the introduction of a digital capability that would allow access to online quote calculators, underwriting and claims lodgement and tracking.

For its part, TAL’s chief executive, Group Life and Retirement, Jenny Oliver described the mandate as an extension of the company’s partnership with AMP.

AMP Limited has made clear in its documentation that AMP super plan members can access insurance as an optional benefit or as part of their default plan.

“The insurance is provided by external insurers and overseen by the AMP super trust.

Within the information set made available to AMP super members have been product disclosure guides from AIA Australia, MLC Life, Resolution Life, Zurich and MetLife.

Another example of highly concerning outcomes which come from ill-defined or open to interpretation legislation. I would like to think…

Dear FAAA We're also disappointed...in you.

Uni Super already does right now, they allow internal advisers to charge clients super funds for advice but doesn't allow…

How can a staff member at a fund manager, removed from the client other than as a name on an…

Why is it, that clients want the service and the advice, Advisers are providing the service and the advice to…